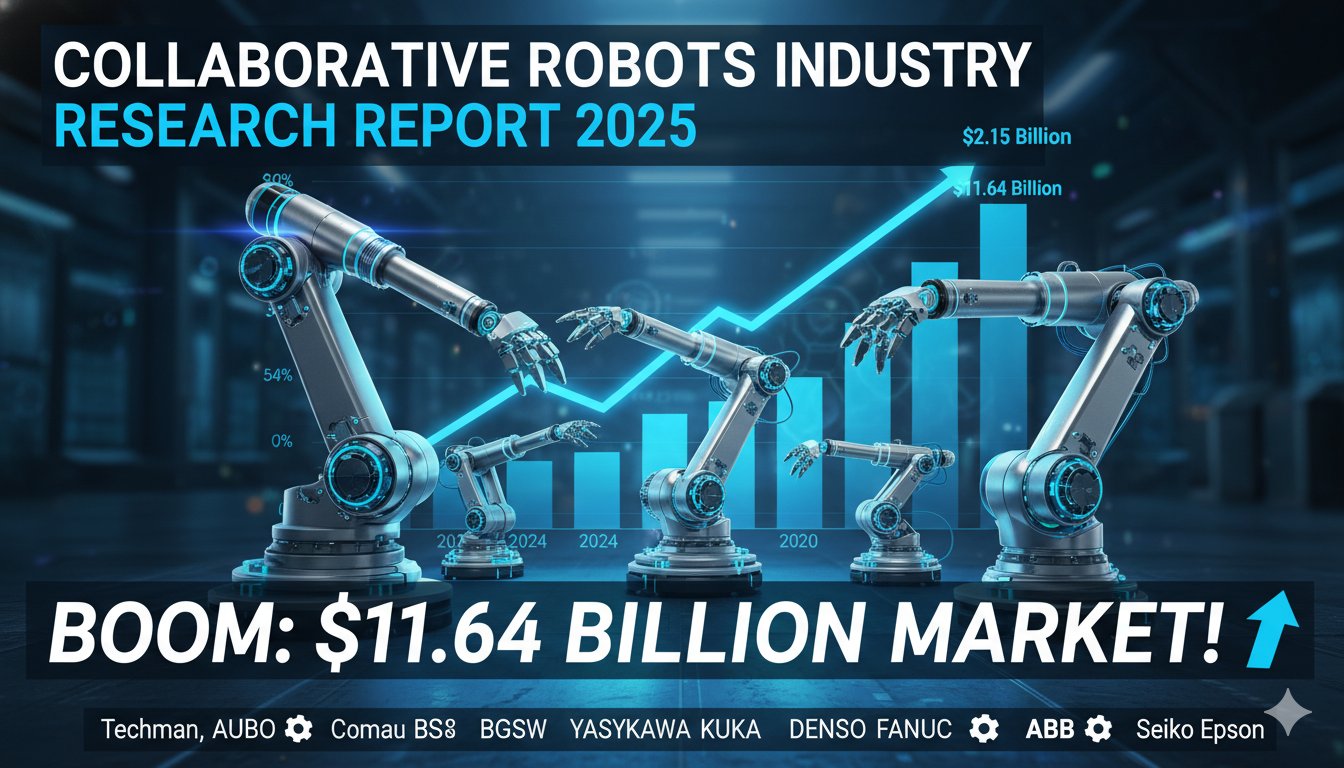

The collaborative robots (cobots) market is poised for explosive expansion, growing from $2.15 billion in 2024 to a projected $11.64 billion by 2030. This surge reflects surging demand for safe, flexible automation solutions that enable human-robot collaboration across industries. Key drivers include superior ROI compared to traditional robots, labor shortages, e-commerce logistics needs, and advancements in AI integration. Leading players such as Techman, AUBO, Comau, BGSW, KUKA, YASKAWA, DENSO, FANUC, ABB, and Seiko Epson dominate innovation, with applications spanning handling, assembly, and emerging sectors like healthcare.

Collaborative Robots Market Booms Toward $11.64 Billion Horizon by 2030

The collaborative robots sector, commonly known as cobots, has transitioned from niche technology to a cornerstone of modern industrial automation. Designed for direct interaction with human workers without safety barriers, these systems prioritize flexibility, ease of deployment, and cost-effectiveness.

Market valuation stood at $2.15 billion in 2024, reflecting steady adoption amid post-pandemic recovery in manufacturing and supply chain resilience efforts. Projections indicate robust expansion to $11.64 billion by 2030, implying a strong compound annual growth rate fueled by technological maturation and broadening applications.

Key Market Drivers

Several factors propel this trajectory:

Superior Economic Returns — Cobots deliver faster payback periods than conventional industrial robots due to lower initial costs, minimal infrastructure needs (no fencing required), and quick reprogramming for task changes.

Labor Market Pressures — Persistent shortages of skilled workers, rising wages, and demographic shifts toward aging populations push companies to automate repetitive or hazardous tasks while retaining human oversight.

E-commerce and Logistics Surge — Rapid growth in online retail demands efficient picking, packing, sorting, and palletizing operations, where cobots excel in variable workflows.

Safety and Flexibility Advantages — Built-in sensors for force limiting and collision detection enable seamless human-robot teamwork, reducing injury risks and enabling deployment in SMEs previously deterred by complex robotics.

Technological Enhancements — Integration of AI, machine vision, and IoT capabilities allows cobots to handle more complex tasks with greater precision and adaptability.

Payload Capacity Segmentation

Cobots are categorized by payload to match diverse operational needs:

Up to 5 kg: Ideal for precision tasks in electronics and small-part assembly; dominates volume due to affordability and versatility.

5-10 kg: Balances reach and strength for medium-duty applications like machine tending and packaging.

Above 10 kg: Emerging for heavier loads in automotive and logistics, with recent models pushing boundaries for high-payload collaborative scenarios.

Application Breakdown

Core uses continue to evolve:

Handling — Material transfer, pick-and-place, and palletizing lead adoption, especially in logistics.

Assembling & Disassembling — Precision fitting in electronics and automotive components benefits from cobot dexterity.

Welding & Soldering — Safe, consistent performance in shared spaces.

Dispensing & Processing — Glue application, painting, and inspection tasks gain traction.

Emerging areas include healthcare support (e.g., patient handling aids) and service-oriented roles.

End-Use Industry Insights

Adoption spans multiple verticals:

Automotive — Remains a powerhouse for assembly and quality checks, with cobots complementing traditional lines.

Electronics — High demand for delicate component handling amid miniaturization trends.

Metals & Machining — Machine tending reduces downtime and ergonomic strain.

Food & Beverages — Hygienic models support packaging and sorting.

Logistics & Warehousing — Fastest-growing segment due to e-commerce volume.

Healthcare & Others — Rising interest in assistive and cleanroom applications.

Competitive Landscape and Key Players

Innovation remains fierce among established and emerging leaders:

Techman — Pioneers integrated vision systems for plug-and-play intelligence.

AUBO — Flexible programming and adaptable architectures suit varied environments.

Comau — Recent launches emphasize precision for European manufacturing needs.

BGSW — Focuses on robust industrial integrations.

KUKA — Leverages legacy strength in high-performance cobots.

YASKAWA — Broad portfolio with strong motion control expertise.

DENSO — Precision engineering from automotive roots.

FANUC — Reliable, high-integration solutions for large-scale operations.

ABB — Advances in AI-enhanced safety and modularity.

Seiko Epson — Compact, high-speed models for electronics.

Recent strategic moves, including acquisitions and new model introductions, underscore commitment to expanding capabilities.

Regional Dynamics

Asia Pacific leads in volume, driven by manufacturing hubs in China, Japan, and South Korea facing labor cost pressures. North America shows rapid uptake in logistics and SMEs, while Europe emphasizes safety-compliant innovations.

Challenges and Future Outlook

Despite momentum, hurdles persist: average revenue per unit erosion from competition, integration complexities in legacy systems, and ongoing needs for enhanced AI to handle unstructured environments. However, trends toward modularity, mobile manipulators, and RaaS models promise sustained acceleration.

The cobot ecosystem stands ready to redefine productivity, safety, and scalability in global industry.

Disclaimer: This is a news and research-based report providing market insights and analysis. It does not constitute financial, investment, or professional advice.